- Field of View (FOV)

- Posts

- Field of View (FOV) - December 2025

Field of View (FOV) - December 2025

Early-Stage Aerospace & Defense Newsletter.

Comprised of experienced startup operators and former DoD, Approach Venture was formed to enable founding teams building the future of frontier technology to achieve their full potential.

Approach supports frontier technology startups across fundraise, business development, proposal writing and recruiting efforts as well as larger organizations with technology scouting, due diligence and market intelligence.

CONTACT APPROACH to learn more. Follow us on LINKEDIN.

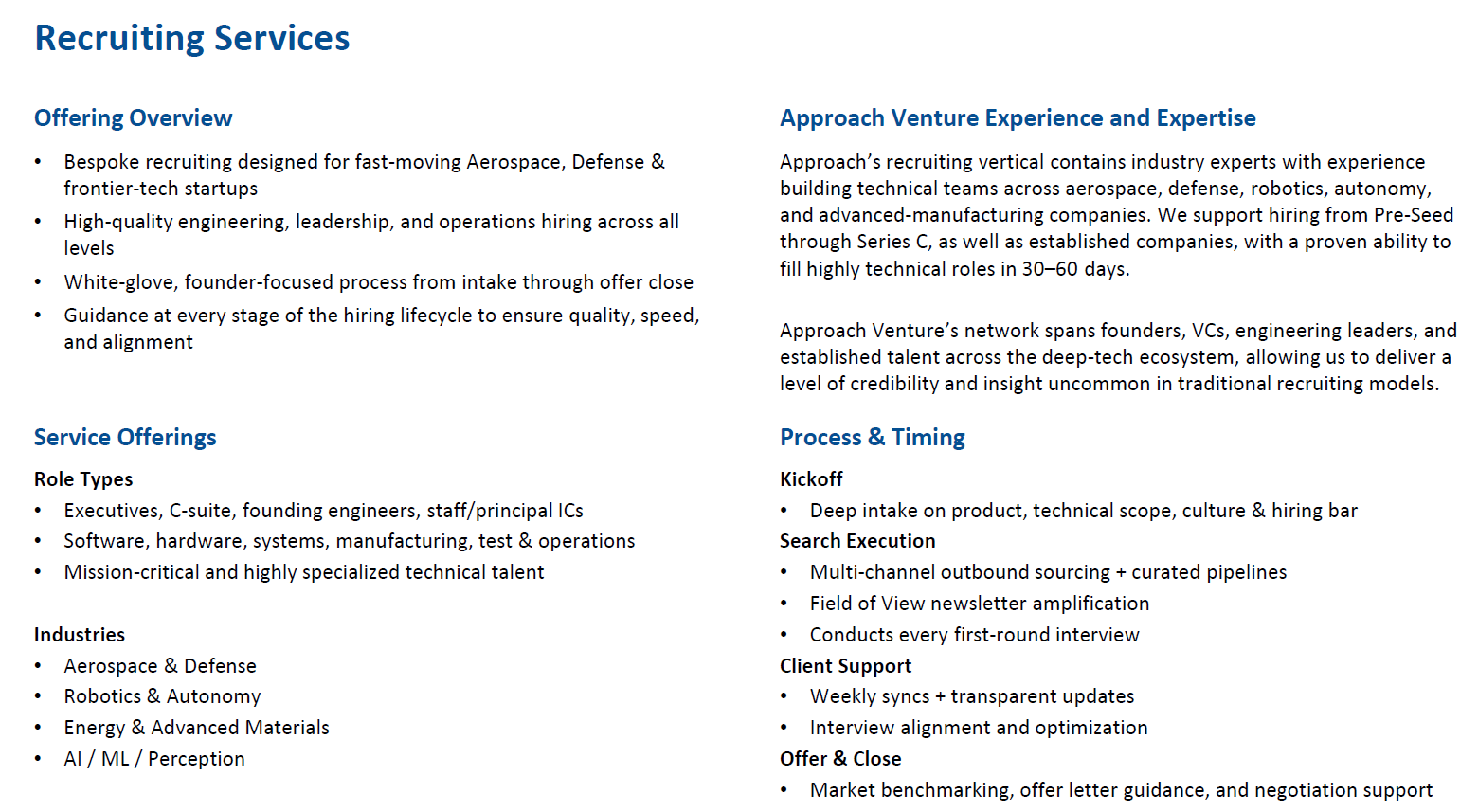

RECRUITING SERVICES

For startup founders looking to hire top talent and quickly, contact [email protected].

CONTACT APPROACH to learn more.

EMERGING TRENDS

SECURING THE SKIES AT HOME.

FEMA has released a new solicitation under its Counter UAS Grant Program aimed at helping state and local governments improve their ability to detect identify track and respond to unauthorized drone activity. The program is designed to strengthen domestic airspace security particularly around critical infrastructure public venues and major national events by funding sensing systems command and control software integration efforts and operator training. The focus is on building situational awareness and coordinated response capabilities rather than kinetic or weaponized solutions. State and local governments are now becoming a meaningful funding source through DHS and FEMA grant programs rather than direct procurement budgets. This marks a transition from expeditionary military use cases to persistent homeland security and public safety deployments where interoperability training sustainment and legal compliance matter as much as raw technical performance.

This signals growing demand from civil and public safety customers for scalable C-UAS solutions that can integrate radar RF electro optical infrared and data fusion tools into a common operating picture. Early engagement with state homeland security and emergency management offices will be critical as funds flow through state administrative agencies. As C-UAS moves beyond defense applications into everyday preparedness, this program represents a meaningful entry point into a rapidly expanding domestic security market.

MODULARITY WINS CONTRACTS.

The Department of War (DoW) is increasingly treating modular open systems as a baseline requirement rather than a nice to have which has real implications for startups. Proprietary architectures may still enable faster early demos but are becoming harder to sustain as programs scale. Government buyers are signaling that long term readiness depends on modularity, open interfaces and the ability to swap components without being vendor locked. For founders, this means design decisions made in the prototyping phase can directly influence credibility, competitiveness and down-range contract opportunities.

Acquisition teams are also navigating the tension between moving fast and building for durability; startups that acknowledge this reality are better positioned to win. Programs still value rapid delivery, but there is growing scrutiny around obsolescence risk, certification pathways and upgrade flexibility. Startups able to articulate a phased roadmap that delivers near-term capability while transitioning to ruggedized, modular and standards aligned architectures are increasingly attractive partners. Modularity is not just an engineering choice but also a GTM and capture strategy that signals long-term alignment with how the DoW plans to buy, field and sustain systems.

TOP TALENT & FEATURED OPENINGS

MATCHING TALENT LEVEL TO ROLE IMPACT.

After the first few hires, often around the five-employee mark, many early-stage companies begin turning to outside recruiting support. Early hires usually come from personal networks, but once those relationships are exhausted and funding is secured, the urgency to fill specialized roles increases. At that point, leaving a key position unfilled becomes expensive in terms of lost progress, and external recruiting support helps teams reach beyond their immediate network to access the broader market. The right recruiting partner understands the industry, has relationships in the field, and can support hiring in a way that fits within startup budgets.

Founders are also becoming more intentional about matching the level of talent to the importance of each role. Not every position requires top-tier or top 0.1% talent, but for mission-critical or highly technical roles, exceptional hires can significantly reduce execution risk. Those hires often require compensation or ownership that goes beyond standard early-stage packages. The most effective founders are realistic about what level of talent they can attract at each stage, which roles are truly critical, and when a strong builder is the right answer. This kind of decisive hiring helps companies move faster and get work done. On the other hand, when a role sits open for four to six months while a team waits for a unicorn candidate or is too rigid with compensation, the company risks missing milestones and sending a market signal that the role is difficult to fill or undesirable. More founders are starting to view hiring as resource allocation: align the level of talent, compensation, and urgency with the actual impact of the role on the business.

FEATURED JOB OPENINGS.

LEAD AVIONICS ENGINEER: This early-stage space startup is building next-generation spacecraft platforms that enable mobility and in-space resource capability, and this role leads the avionics systems that make those missions possible. It’s an opportunity to own the full electronics architecture from concept through flight, shaping how critical systems are designed, tested, and qualified for real spacecraft operating in demanding orbital environments. Location: Los Angeles, CA (on-site) |

SENIOR MANUFACTURING ENGINEER: This defense-focused startup is scaling next-generation composite manufacturing and needs a Senior Manufacturing Engineer to help take production from prototype to full-rate build. The role is hands-on across tooling, work instructions, process control, and throughput improvement, with significant ownership over how new production lines are designed, stabilized, and scaled to support mission-critical hardware. Location: Los Angeles, CA (on-site) |

LEAD MAGNETICS ENGINEER: This venture-backed space startup is developing modular spacecraft that autonomously assemble and reposition once in orbit, and this role leads the magnetic systems that make that possible. It’s an opportunity to design and scale hybrid electromagnetic hardware that enables docking, alignment, and cooperative behavior in space, defining how next-generation orbital platforms interact and operate together. Location: Denver, CO (on-site) |

SENIOR MECHANICAL ENGINEER: This growing space hardware company is building advanced RF and electronics systems for next-generation satellites, and this role takes full ownership of the mechanical design that makes those systems flight-ready. It’s a hands-on opportunity to drive product development from concept through qualification while solving complex packaging, thermal, and structural challenges for mission-critical space applications. Location: Camarillo, CA (on-site) |

ELECTRICAL ENGINEER: This venture-backed space startup is building advanced propulsion and power systems for next-generation spacecraft, and this role owns the electrical hardware that makes those systems possible. As the sole Electrical Engineer on a small, highly technical team, you’ll design and qualify high-voltage power electronics and embedded control systems that move directly from lab testing into flight-ready hardware for government and commercial missions. Location: Los Angeles, CA (on-site) |

FACILITIES DIRECTOR: This fast-scaling photonics and advanced manufacturing company is building one of the most sophisticated production environments in the country, and this role is responsible for the infrastructure that makes it possible. It’s a high-impact opportunity to design, expand, and optimize a factory where precision, throughput, and reliability are mission-critical as the team moves toward high-volume output. Location: Los Angeles, CA (on-site) |

VP OF MANUFACTURING: This emerging deep-tech startup is building a next-generation additive manufacturing platform for aerospace and defense, and this role leads the transformation from early prototypes to a scalable, high-reliability production operation. It’s a chance to architect factory systems, shape the manufacturing culture, and guide the buildout of a first-of-its-kind composite hardware capability with significant national impact. Location: Broomfield, CO (on-site) |

LEAD STRESS ENGINEER: This growing composites startup is developing next-generation manufacturing methods for high-performance structures used in defense and aerospace, and this role leads the structural analysis discipline behind that technology. It’s an opportunity to build the FEA framework from the ground up, connecting material characterization, simulation, and real-world testing to shape how complex composite systems are designed, validated, and scaled into mission-critical hardware. Location: Los Angeles, CA (on-site) |

LEAD AI / ML ENGINEER: This defense-tech startup is building autonomous defense systems that rely on advanced machine learning at the edge, and this role leads the AI that makes real-time perception and decision-making possible. It’s a chance to architect and deploy low-latency models that classify, track, and respond to aerial threats in dynamic environments, shaping the intelligence layer behind next-generation autonomous platforms. Location: Austin, TX (on-site) |

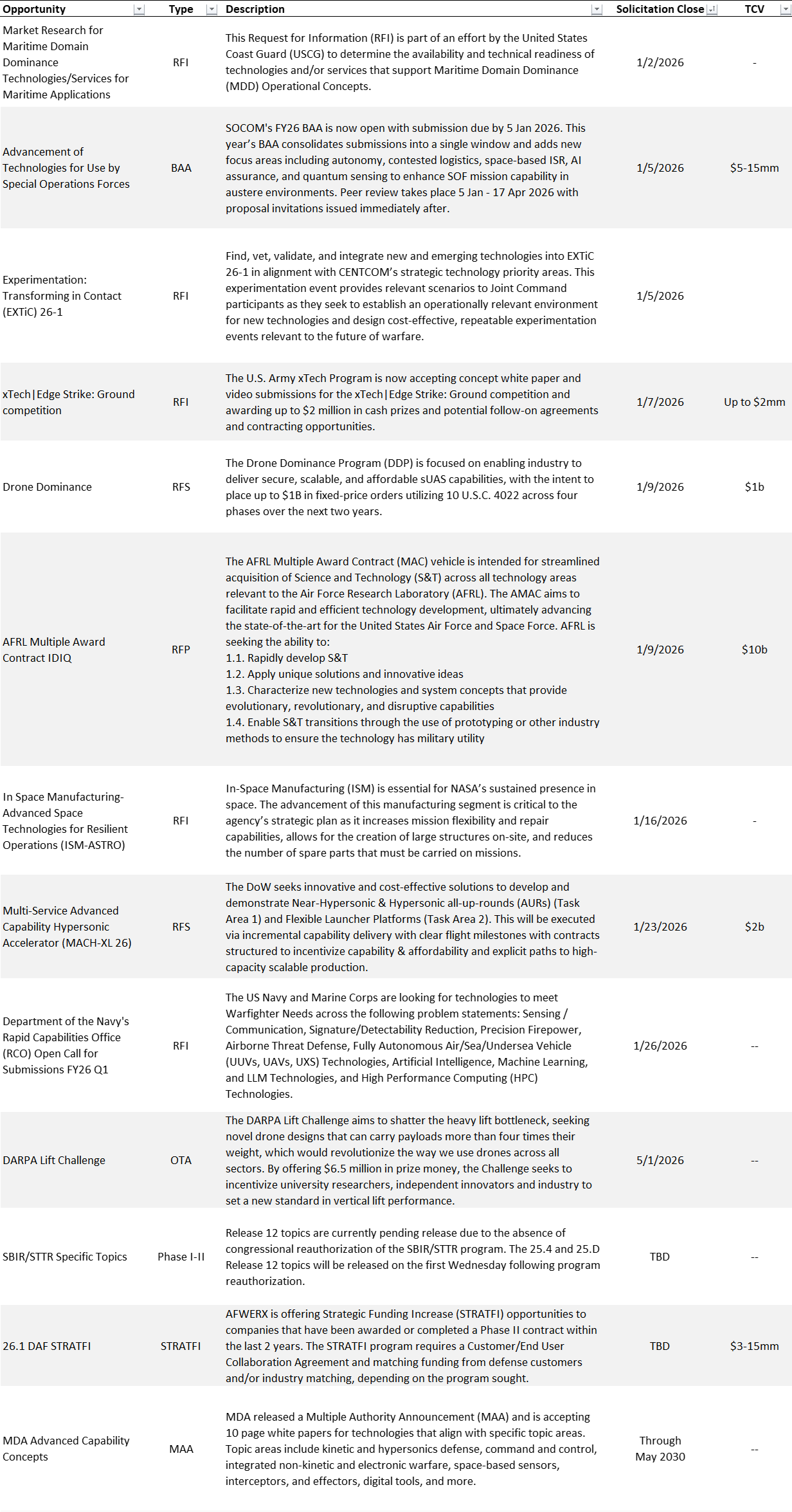

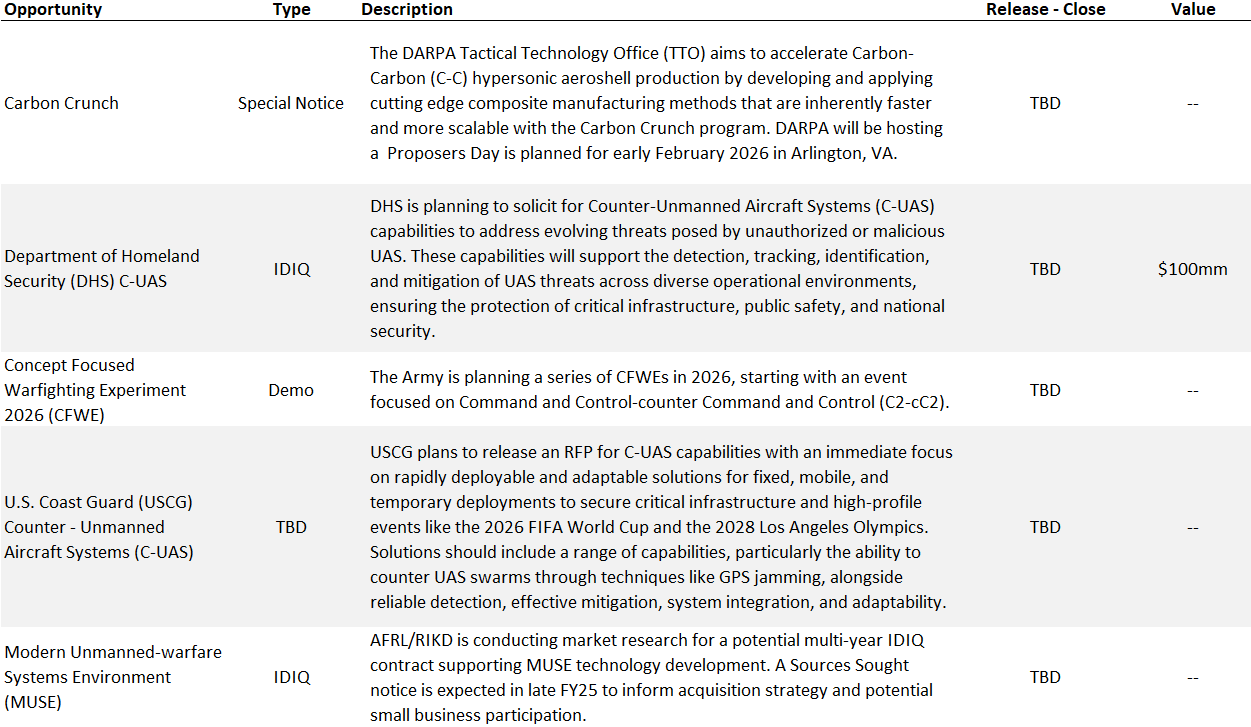

TRACKED SOLICITATIONS

The continued lapse in SBIR/STTR reauthorization creates uncertainty that may further delay the release of solicitations and notifications of award from prior submissions. As a result, companies monitoring upcoming topics should prepare for potential schedule slips and reduced visibility into when specific opportunities will open.

Approach is tracking several organizations that are releasing opportunities regardless of the SBIR/STTR reauthorization, including but not limited to AFLCMC, NSTXL, DIU, DARPA, xTech, and Vulcan.

ACTIVE.

UPCOMING.

VENTURE UPDATE

HOUSE PASSES PACKAGE OF BILLS AIMED TO BOOST VENTURE CAPITAL.

THE HOUSE OF REPRESENTATIVES passed the INVEST Act, which contains 22 different pieces of legislation, aimed at de-regulating and increasing the capital pool for venture capital funds. The bill includes raising the limit on how many secondary and fund-of-funds investments a VC can make while maintaining RIA exemption from 20% of AUM to 49%.

The bill also would also double the beneficial owner limit for qualifying VC funds to 500 and increase the capital limit from $10mm to $50mm. The bill has now been introduced in the Senate where it is expected to have bipartisan support.

AEROSPACE AND DEFENSE STARTUPS RAISE OVER $19 BILLION SO FAR IN 2025.

A&D STARTUPS have raised more than $19 Billion in 2025 according to PitchBook, up from $10 Billion in 2024. This includes $600mm raised by Saronic in February, $2.5 Billion by Anduril in June and $510mm by Chaos Industries in November.

FOUNDER TIP

PLAN AS IF SBIR IS NOT COMING ONLINE.

While SBIR Reauthorization will likely take place in Q1 2026, plan to pursue opportunities outside of the program.

Link to Last Month’s Newsletter HERE.