- Field of View (FOV)

- Posts

- Field of View (FOV) - August 2025

Field of View (FOV) - August 2025

Early-Stage Aerospace & Defense Newsletter.

Comprised of experienced startup operators and former DoD, Approach Venture was formed to enable founding teams building the future of frontier technology to achieve their full potential.

Approach supports frontier technology startups across fundraise, business development, proposal writing and recruiting efforts as well as larger organizations with technology scouting, due diligence and market intelligence.

CONTACT APPROACH to learn more. Follow us on LINKEDIN.

SPONSORED JOB BOARD

This month’s Field of View contains open roles at Aerospace & Defense startups. Each team venture backed and moving quickly. Company and role descriptions as well as job links are outlined below.

Backed by a16z, AE Ventures, Cantos, and Harpoon, Salient Motion is hiring a Senior Mechanical Engineer to lead the full-cycle design of production hardware, test equipment, and electromechanical systems working across design, CAD, DFM, GD&T and collaborating with contract manufacturers, while also engaging in gearbox or actuator design.

In parallel, Salient is seeking an Electrical Engineer to focus on electrical hardware development from requirements and component selection to schematic capture and PCB layout using Altium plus electrical evaluation, manufacturing documentation, and test validation.

Backed by a16z’s American Dynamism fund and other leading defense-focused VCs, Swan develops scalable autonomous products to advance the future of defense and industry. The team is seeking a Robotics Software Engineer with expertise in C++ and Python, strong experience in robotics and sensor data and a background in aerial systems like UAVs/UAS. The role is hands-on and ideal for someone who thrives on solving complex problems and building real-world robotic systems.

Startup | Product Focus | Role Location | Job Title / Link |

|---|---|---|---|

Actuators | Torrance, CA | ||

Actuators | Torrance, CA | ||

Autonomous Solutions | Remote |

EMERGING TRENDS

ON-ORBIT ASSEMBLY OF LARGE STRUCTURES.

Ahead of what we all know is coming in 2027, USSF organizations and Primes are interested in modular spacecraft architectures that can self-assemble in orbit, reducing reliance on complex deployment mechanisms. This approach is being driven by the need for on-orbit protection of assets as well as larger antennas and solar arrays that exceed launch vehicle fairing constraints. Reconfigurable and repairable systems being produced by startups are gaining significant traction, offering resilience through redundancy and the ability to adapt to new mission requirements post-launch. On-orbit assembly also addresses longstanding challenges with power generation and heat dissipation, enabling higher duty cycles for advanced payloads.

Companies producing on-orbit assembly technologies are leveraging the ISS and other commercial test beds to increase TRL which aid in initial feasibility of these modular systems and validate technologies for autonomous assembly. Interest is particularly strong in phased array antennas and large-scale solar generation, both of which directly enhance mission utility across defense and commercial applications. Traditional deployables have an all-or-nothing risk while more modular approaches allow for replacement of degraded or failed units. With operational flexibility being at the forefront of most DoD missions, rapid reconfiguration timelines (days not weeks) could unlock some unique mission sets for offense and defense capabilities. Overall, the trend points toward a future where spacecraft are launched as compact flat packs and assembled into massive, mission-optimized platforms in space – did you watch Starship’s recent disc-like deployments? This is a good example of compact spacecraft. Approach is recognizing this modular approach not only from ISAM focused teams but also across new space bus providers.

DIGITIZATION OF METAL CASTINGS.

Domestic supply chains for high-performance castings remain a major bottleneck, with traditional lead times stretching from months to years. Dual-use demand signals show a need for rapid-turnaround castings especially in aluminum, stainless steel and nickel alloys to support both R&D and production programs. Several early-stage startups are attacking this problem by producing digital foundries that automate mold design and leverage 3D-printed tooling are emerging as a solution to reduce cycle times from the aforementioned months to years down to days from CAD receipt to part delivery. This speed advantage is particularly attractive for low-volume, high-complexity parts such as pump housings, turbomachinery components and valves (a major pain point across the propulsion industry) – historically, castings were only used for high volume orders because it didn’t make sense for low-volume.

By eliminating tooling costs and enabling quick design iterations, these methods allow engineers to experiment with novel geometries traditionally reserved for additive manufacturing. Supply chain managers are prioritizing flexible vendors that can accommodate one-off and small batch orders, avoiding long-term agreements that constrain responsiveness. At the same time, qualification and certification pathways remain a hurdle, as programs range from rapid prototyping with minimal oversight to fully audited, defense-grade requirements. The push for integrated capabilities across manufacturing suppliers (not just castings) including in-house inspection, finishing and coatings reflects recognition that downstream processes can add as much delay as casting itself. Growing concerns over rare earth element availability are further driving interest in domestic manufacturing options to reduce dependency on foreign suppliers – this is also an emerging area where Pre-Seed to Seed stage companies are raising with roadmaps focused on rare earth element extraction as well as picks and shovels to make it happen. Overall, advanced digital casting is positioning itself as a critical enabler of both speed and resilience in aerospace and defense supply chains with buyers in stage from startups to well-established Primes.

C-UAS DETECTION, TRACKING & ENGAGEMENT.

C-UAS technologies are advancing rapidly, with emphasis on high-speed detection, tracking and engagement against evasive drones. Aerial, ground and maritime surface vehicle integration is becoming a key milestone as lightweight, modular systems are designed for mounting on tactical platforms without compromising mobility. During supplier due diligence, C-UAS solution buyers are now prioritizing realistic test scenarios, including swarming, aggressive maneuvers and low-altitude attacks, to validate reliability in the contested conditions they operate within. Many startups are testing these capabilities with loitering as opposed to moving drones which is unfortunately not when dual-use buyers and their DoD customers want them to work. Safety measures such as no-fire zones and redundant hardware/software interlocks are increasingly standard, reflecting operational maturity.

Power flexibility is another emerging need, with systems adapting to multiple vehicle voltage levels to ensure seamless deployment across fleets. The shift toward dual kinetic and non-kinetic defense layering highlights demand for adaptable and multi-domain protection. Open architecture approaches allow linking of multiple defense nodes which pave the way for distributed, networked counter-drone operations. Lightweight packaging and modular design enable rapid installation and removal which align with expeditionary mission requirements. DoD exercises and commercial demonstrations are becoming more immersive, incorporating high-fidelity scenarios to prove battlefield relevance.

TOP TALENT & FEATURED OPENINGS

IMPORTANCE OF STRUCTURED HIRING PROCESSES.

The way a hiring process is run signals to candidates whether a team is disciplined. The key is to start with clarity around the role, timelines and decision points to set expectations from initial contact. Straightforward tools for scheduling and follow-ups help remove friction and keep momentum steady. Take-home projects can be valuable if they are concise and tied to real-world work while lengthy or vague assignments often deter strong candidates, especially those already weighing multiple offers.

Every step of the process reflects on the organization’s brand. Mission-driven candidates will tolerate some startup chaos but they will not remain interested if the process feels sloppy or their time is wasted. Clear scheduling, consistent communication and disciplined scorecards often matter more than the offer itself when candidates are choosing their next role / mission. Startups that execute on this consistently are the ones that win top talent while competitors miss out on candidate opportunities.

FEATURED JOB OPENINGS.

HEAD OF FLIGHT SOFTWARE: An ambitious and investor-backed aerospace startup is pioneering modular and autonomous spacecraft systems for dynamic orbital operations. Own the entire flight software stack, building and deploying mission-critical systems from the ground up before growing into a leadership role to build and scale the engineering team. Location: Golden, CO (hybrid) |

SENIOR MECHANICAL ENGINEER: A venture-backed startup is building smart factories that merge robotics, composites, and advanced 3D printing to transform aerospace and defense manufacturing. Design, prototype, and operate industrial-scale systems while taking a hands-on role in machining, fabrication, and process development to drive breakthrough production capabilities. Location: Broomfield, CO (onsite) |

PRINCIPAL ROBOTICS ENGINEER: A fast-growing, pre-seed defense robotics startup is developing autonomous ground systems to counter aerial threats in complex environments. Lead the development of the complete autonomy stack, including firmware, control, perception, and real-world testing, shaping tactical robotics from concept to field deployment. Location: Austin, TX (onsite) |

INFRASTRUCTURE ENGINEER: A venture-backed startup is redefining how complex machines are tested, scaled, and operated by building a platform for real-time engineering observability. Architect and evolve the core systems that power distributed, mission-critical applications while shaping the culture and foundation of a fast-moving, early-stage company. Location: El Segundo, CA (hybrid) |

OPTO-MECHANICAL ENGINEER: A well-funded, seed-stage space startup is pioneering the world’s first orbital power network, delivering energy across spacecraft with advanced optical and mechanical systems. Design, integrate, and validate precision hardware that aligns and stabilizes optics for space-to-space power transfer, directly impacting next-generation orbital infrastructure. Location: Jacksonville, FL (onsite) |

SPACECRAFT POWER ELECTRONICS ENGINEER: An innovative, pre-seed space startup is building advanced spacecraft platforms powered by scalable, efficient energy systems. Develop and validate power hardware, including solar arrays, batteries, and distribution units, to ensure reliable performance under the most challenging space conditions. Location: San Francisco, CA (onsite) |

LEAD MECHANICAL ENGINEER: A stealth, venture-backed company at the forefront of photonics is creating the first US optical interconnect packaging facility for high-volume manufacturing. Own the design and scaling of automation lines and production systems, driving the build-out of a factory that redefines data movement in advanced computing. Location: Los Angeles, CA (onsite) |

TRACKED SOLICITATIONS

Contact [email protected] for proposal support.

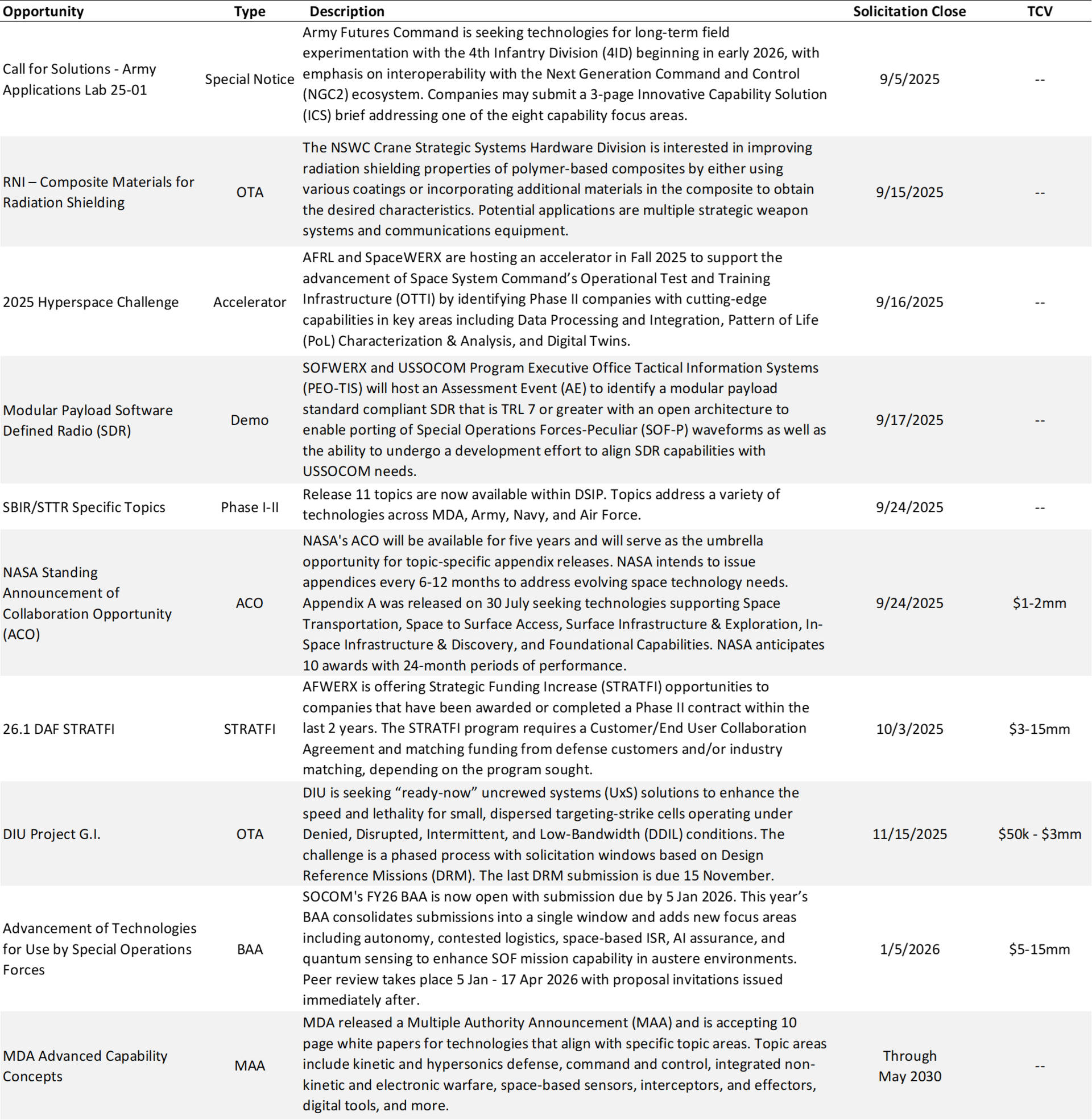

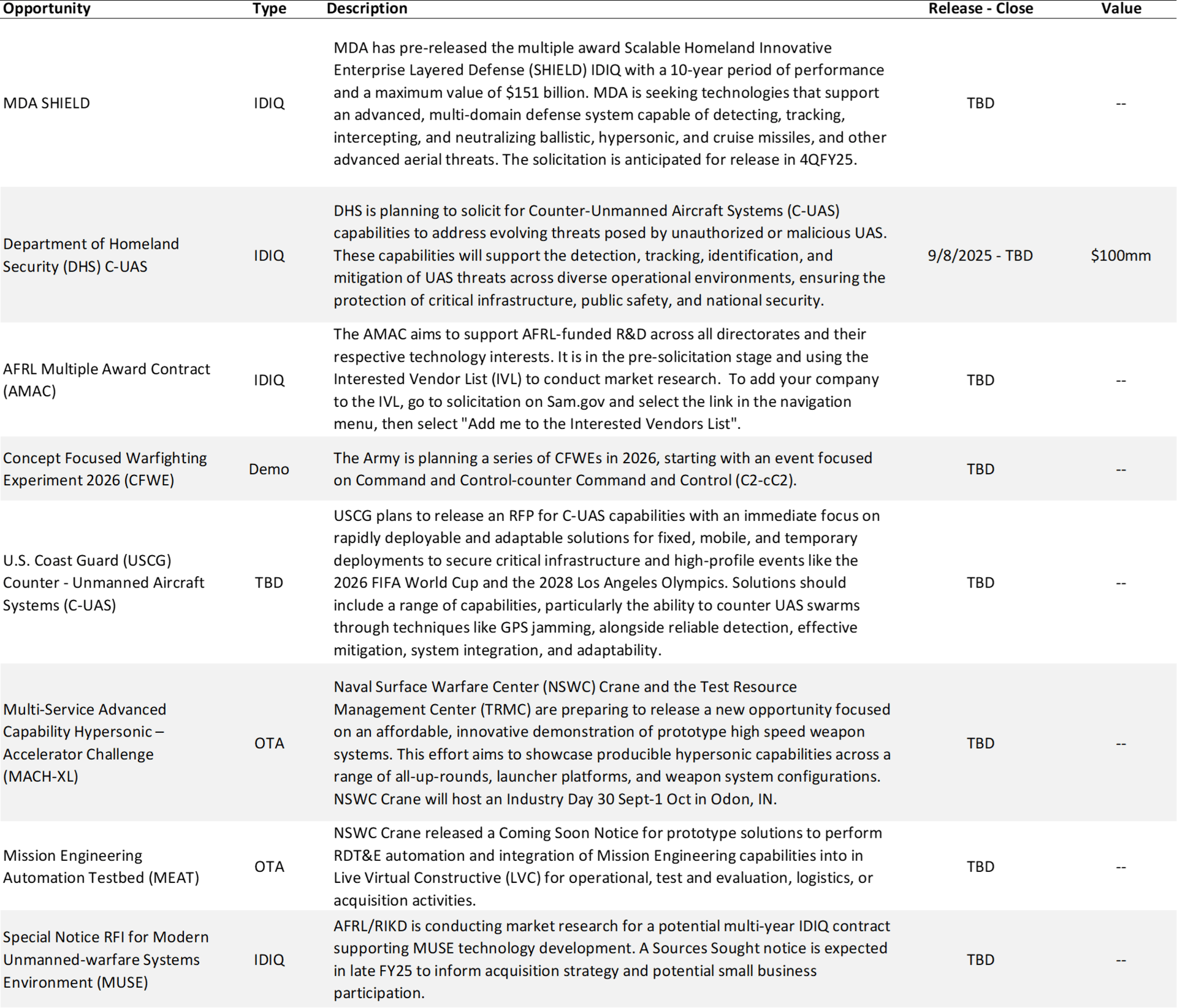

ACTIVE.

UPCOMING.

VENTURE UPDATE

FORWARD DEPLOYED VC RAISES $45 MILLION FUND II.

Forward Deployed Venture Capital (FDVC), a venture firm whose thesis focuses on defense and security, has raised a $45 million Fund II with backing from 150 limited partners including current and former Palantir, Anduril and SpaceX employees.

FDVC General Partner Mark Scianna, who previously spent 11 years at Palantir, said the fund will target early-stage investments in companies working in mission-critical sectors. He emphasized that software and technology have yet to fully transform industries such as energy, defense, supply chain, and manufacturing, where FDVC sees significant opportunity. Scianna’s path into venture capital began during his time at Palantir, when he started making informal, individual startup investments as early as 2009, including an early bet on Palantir itself.

Founded in San Francisco in 2022 with an initial $10 million Fund I, FDVC is now expanding its investment capacity with the launch of Fund II.

FOUNDER TIP

INVESTOR & CUSTOMER UPDATES > FOLLOW-UPS.

Instead of following up with VCs or potential customers to ask them for updates on go / no-go on investment in your startup or procurement of your product since your last discussion, it is best to provide both parties with value-add updates to keep comms warm.

This could include recent Company expansion announcements, links to press releases the day they are published, addition of strategic advisors, technical progress updates and/or recently awarded contracts and agreements. If none of these are the case, contact Approach to ramp your pipeline quickly in order to scale effectively.

Link to Last Month’s Newsletter HERE.